Adobe Acrobat

Understanding SBA loans.

A loan from the Small Business Administration can be essential for your business’s cash flow. Explore the different loan programs and how to determine your eligibility.

Small business loans keep the lights on.

Any small business owner will tell you that you have to spend money to make money. It’s difficult for a small business to flourish without enough working capital to upgrade equipment, hire more staff, or expand to a new location.

The US Small Business Administration (SBA) offers a variety of loan options for qualifying small business owners. With competitive interest rates and manageable repayment terms, SBA loans can do a lot to keep your balance sheet in the black.

What is an SBA loan?

The first thing to understand about SBA loans is that the SBA does not loan money directly to small business owners. Instead, the SBA guarantees loans made by banks, credit unions, and other lenders they’ve partnered with. This reduces risk for SBA lenders, who must abide by the administration’s guidelines in order to receive the government’s guarantee of the loan.

To qualify for an SBA loan, borrowers must meet a number of eligibility requirements. They must be a for-profit business physically located in the United States or its territories, and they must be able to prove that they have invested in their business and are unable to receive a loan anywhere else.

Types of SBA loans.

There are various SBA lending programs available for different business needs:

SBA 7(a) loans

The SBA’s most common type of loan, the 7(a) Loan Program offers financial assistance to small businesses that have special circumstances. A 7(a) loan can be a great choice if you need to purchase commercial real estate to expand your business, but you can also use it to purchase more supplies or refinance your existing business debt. The maximum loan amount for a 7(a) loan is $5 million.

SBA 504 loans

If you’re looking for a long-term loan, the 504 Loan Program could be for you. You can use these fixed-rate loans of up to $5 million to finance construction or new machinery and equipment. But there are restrictions: The money can’t be used for refinancing debt or investing in rental real estate.

SBA Microloans

Nonprofit community-based organizations administer microloans, which offer up to $50,000 to cover startup costs and expansions for small businesses and some not-for-profit childcare centers. Funds can be used to invest directly in your business, including purchasing inventory, furniture, fixtures, or an array of other products. However, microloan proceeds cannot be used to pay existing debts or buy real estate.

How Acrobat can help you apply for an SBA loan.

While the application process is different for every kind of SBA loan, you can count on a lot of paperwork no matter which route you choose.

To qualify for an SBA loan program, you’ll be expected to provide a vast assortment of paperwork, such as financial statements, your FICO credit score, tax returns, documentation of your business’s annual revenue. Acrobat offers a number of features that make it easier to manage all the documents for your loan application.

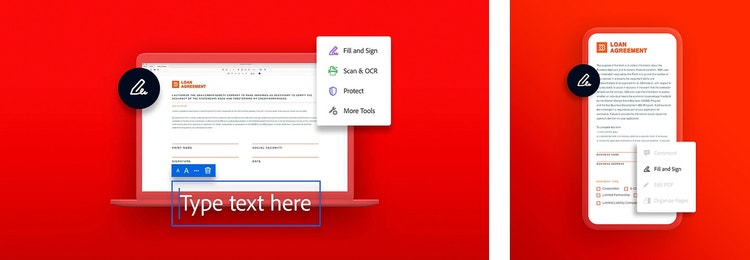

Fillable forms

With shareable, editable PDFs, it’s easy to gather signatures from multiple collaborators involved with the same loan application, as well as keep track of who still needs to sign which forms.

Acrobat compatibility

With Acrobat, you can keep all of the documents for your SBA loan application digital. That’s not just helpful for the environment and your print budget — it also means you can store them online and access them from anywhere.

Searchable file databases

Save time and reduce stress by using the search bar to quickly find the document you need using keywords, or filter your files by date to find every document from a set period of time.

Whether you’re starting a brand-new business or just expanding to a new branch, a loan from the Small Business Administration could help make your entrepreneurial dreams a reality.

You might also be interested in…

Online contract signing keeps business moving.

Learn how to create templates from your contracts and use e-signatures to streamline the signing process.

Create a promissory note that delivers.

No matter the loan, lender, or borrower, it’s usually a good idea to put it in writing. Find out the information useful to include and the fastest, more reliable way to digitally complete a loan contract.

Make paperwork easier with e-docs.

Learn how electronic documents can streamline business processes and filing systems while ensuring simple and more secure access to your documents.

Meet your legal and compliance standards with help from Acrobat Sign.

E-signature requirements

Manage agreements and meet your legal requirements with help from Acrobat Sign.

E-Signature legality

Acrobat Sign helps you meets many of the highest electronic signature legal standards around the globe.

Electronic and digital signature compliance

Use Acrobat Sign to help you stay compliant — from nearly anywhere.

Ready for end-to-end digital processes?

No matter where you are in your journey, take the next step with Adobe Document Cloud.

https://main--dc--adobecom.hlx.page/dc-shared/fragments/seo-articles/acrobat-color-blade